2022 KAPAL–KHIDI Bio & Health Webinar Series는 한미생명과학인 협회 (KAPAL)와 KHIDI 미국지사 웨비나 시리즈입니다.

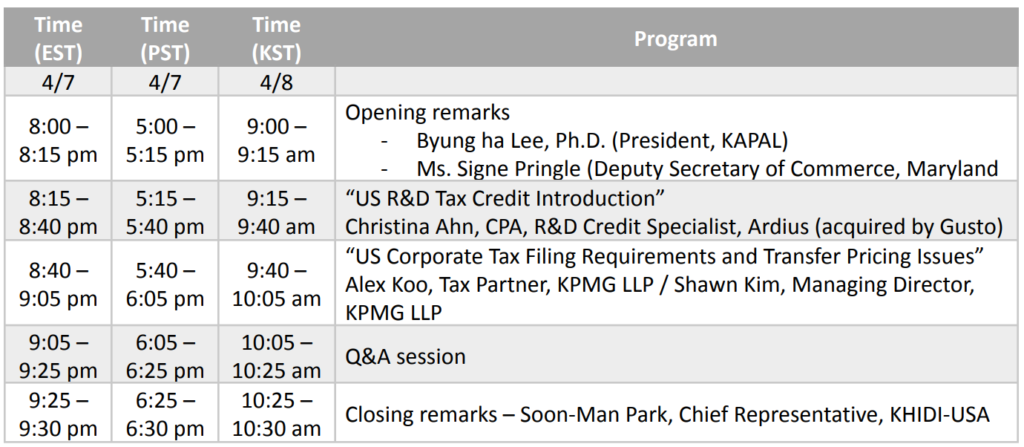

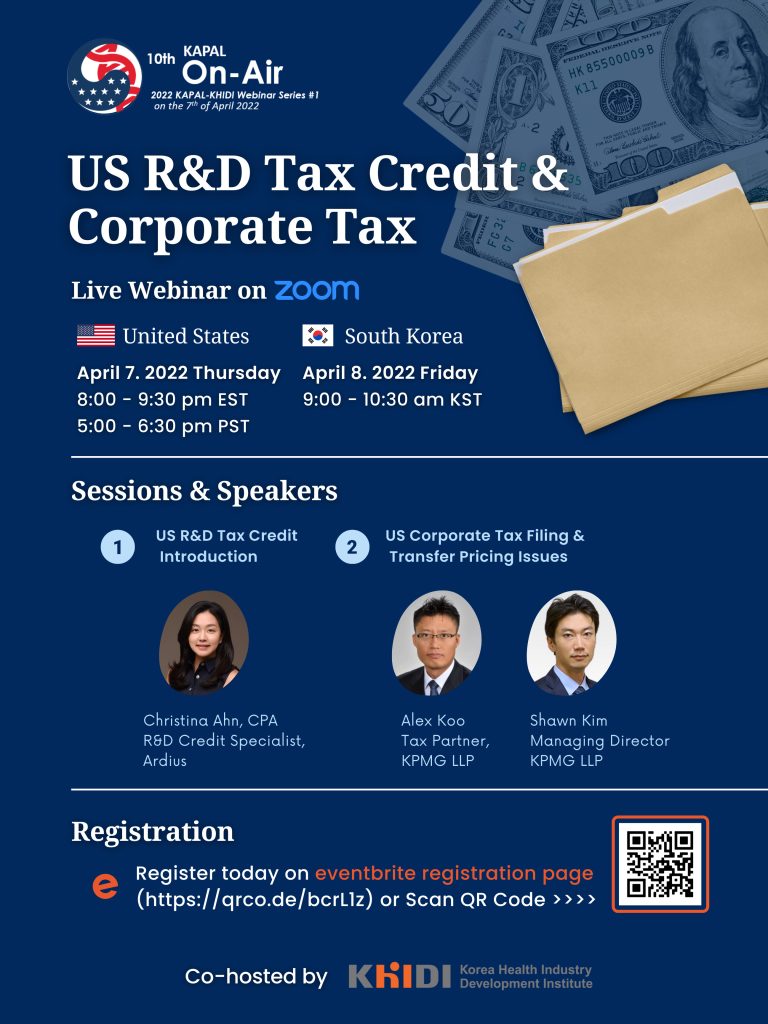

Topic Title: US R&D Tax Credit & Corporate Tax

o “US R&D Tax Credit Introduction”

Christina Ahn, CPA, R&D Credit Specialist, Ardius (acquired by Gusto)

o “US Corporate Tax Filing Requirements and Transfer Pricing Issues”

Alex Koo, Tax Partner, KPMG LLP / Shawn Kim, Managing Director, KPMG LLP

About the presenter:

Christina Ahn, CPA

R&D Credit Specialist, Ardius (acquired by Gusto)

Co-founder and CEO, Pinecone41

Pinecone41 is a Fintech startup that specializes in R&D Tax Credit services and provide technology startups accurate and beneficial tax insights that can be used to fuel growth.

Top Skills

Financial Analysis, Data Analysis, Corporate Tax

Experience

Ardius (acquired by Gusto, R&D Credit Specialist), Pinecone41 (CEO), KPMG (Tax Manager), Deloitte Tax LLP (Senior Tax Consultant), Mah & Associates (Staff Accountant)

Alex Koo

Tax Partner, KPMG LLP

Alex is a Tax Partner in KPMG’s Los Angeles Federal Tax Services, Korean practice. Before joining KPMG, Alex started his career in the tax department of Deloitte Korea and performed various tax projects until he was seconded to the US office. He has more than 20 years of experience in U.S. and Korea tax consulting, income tax compliance and income tax provision.

Alex is responsible for a broad range of U.S. multi-national and foreign-owned clients doing business as single entities or joint ventures, and has extensive experience with a wide range of tax matters relating to multi-national businesses. Alex’s current and past clients include leaders in the industrial production industries and high-technology, media, and telecommunication industries.

Alex has provided tax compliance services for various engagements in size from private to multi-national public companies in the U.S. and Korea and has extensive experience in defending corporations against tax examinations by Federal and state tax authorities.

Alex also has provided tax consulting services related to merger & acquisition transactions, business transfer transactions, cross border transactions and various tax due diligence services.

Alex has strong tax technical skills and tax provision skills with extensive experience in ASC 740 and ASC 718-10 for multinational and private companies.

Shawn Kim

Managing Director, KPMG LLP

Sanghoon has over 18 years of experience in dealing with audit, tax and transfer pricing matters for multinationals operating in different industries, from manufacturing and distribution sectors to the financial industry.

Sanghoon manages tax planning, audit defense and documentation projects for significant and complex intercompany transactions, covering tangible goods, complex services, intellectual property and financing structures. He deals with tax authorities on behalf of taxpayers with respect to transfer pricing audit defense and Advance Pricing Arrangements.

Work Experience

• Dealt with tax authorities related to tax audit, tax appeal, advance pricing agreement (APA), and mutual agreement procedure (MAP)

• Assisted companies in preparing worldwide transfer pricing policies

• Assisted companies in preparing FIN 48 analyses

• Prepared transfer pricing planning study and contemporaneous transfer pricing documentations

• Prepared management service fee documentation

• Performed intellectual property valuation analyses

• Performed royalty analysis products, especially in automobile parts industry

***** Notice *****

* Please note that the webinar talk will be presented in ENGLISH language. But Q&A session will be conducted in both English and Korean.

* 이번 세미나는 Maryland 주정부 관계자 분들을 포함하여 영어권 참석자 분들이 있어, 강의는 영어로 진행될 예정입니다. 참고로 질의 응답은 영어와 한국어 모두 가능함을 안내 드립니다.